- Taxes are not likely to be lower when you retire.

- At best they may be the same as the are now but likely hood is they will be higher.

- Meaning you will pay significantly more in taxes in retirement than if you went ahead and pay the taxes now.

- Section 401(k) says you don't pay taxes now, while you are saving. but when you retire, at unknown tax rates

- If you were shopping for a mortgage and a bank would not tell you the interest rate they are going to charge you, you would keep shopping.

- Why would you let that happen with all of your retirement savings?

- Despite what you may believe to be true you do not have to risk your money in order for it to grow.

- Would you prefer to be able to grow your money without risk if you were able?

- Americans have accepted the tax and risk paradigm without asking any questions as to what the impact to their retirement will be.

- Your retirement is not a time to compromise and leave your standard of living up to unknown tax rates and market risk.

- The TFFP program eliminates these risks by using another section of the IRS tax code...

The TFFP program uses Title 26 Section 7702 of the IRS tax law. Just a few pages back from Section 401[k].

So, we're using the same tax law book but showing you a tax law that will benefit you more.

Here is what Section 7702 does for those who use it...

- All of the income from Section 7702 plans is income-tax free.

- This results in a significant tax savings by paying your taxes now, at known rates, that are likely lower then they will be in the future.

- The bad news is that you must pay taxes.

- The good news is that you can choose what taxes you pay and you can minimize them as much as possible.

- Your custom report will show you exactly how much of a tax savings you can enjoy.

- You need an Income to maintain your standard of living In retirement.

- The TFFP program generates 40%-60% more Income per year In retirement.

- In some situations income can be doubled.

- So, If you were going to choose a 401(k) option because that is what everyone else uses, or another tax law that can double your Income from the same money you are saving now, which would you choose?

- You don't have to risk your money in order to grow it.

- Risking your money to grow it is an out-dated way of thinking

- Warren Buffett's two rules of Investing...

- Rule 1-Never lose money.

- Rule 2-Never forget rule #1.

- By not worrying about the market taking a day off you can have confidence in your retirement plan and achieving your goals.

Our custom reports will show you how much in taxes you will save if you use a 401(k), or other qualified plan, from now until retirement.

Then it shows how much in taxes you will owe in retirement. Think of this as debt in retirement. If you have never seen your potential tax burden this may be shocking to you.

Thankfully, using a TFFP program allows you to chose to pay the smaller tax bill instead of the larger one in retirement.

The below is an example of of the custom report that can be generated for you and your retirement.

The values below show the potential total taxes paid based on the current market assumptions on the previous page, including:

- You save in a qualified account

- You retire at age 66

- You live to age 95

- You take $54,824 in distributions from the account annually 1

- You are taxed on distributions as you access them, and taxed on remaining account value (if any) at death

The TFFP plans are the only financial products in the country that can grow your retirement that will not lose any value due to a market correction.

That means you can grow your money without risking it. Here are three examples of how TFFP plans have performed compared to 401 [k]s invested in the market.

This is before taxes and fees. The actual return would be closer to 4% to 4.5%

Negative 1% is not a net number. Taxes and fees have not been considered. TFFP plans were able to outperfom the market becuase they did not lose when the market dropped.

Less than 3% for 30 years. The difference from 2.9% and 4.5% in retirement is tens of thousands of dollars a year in income.

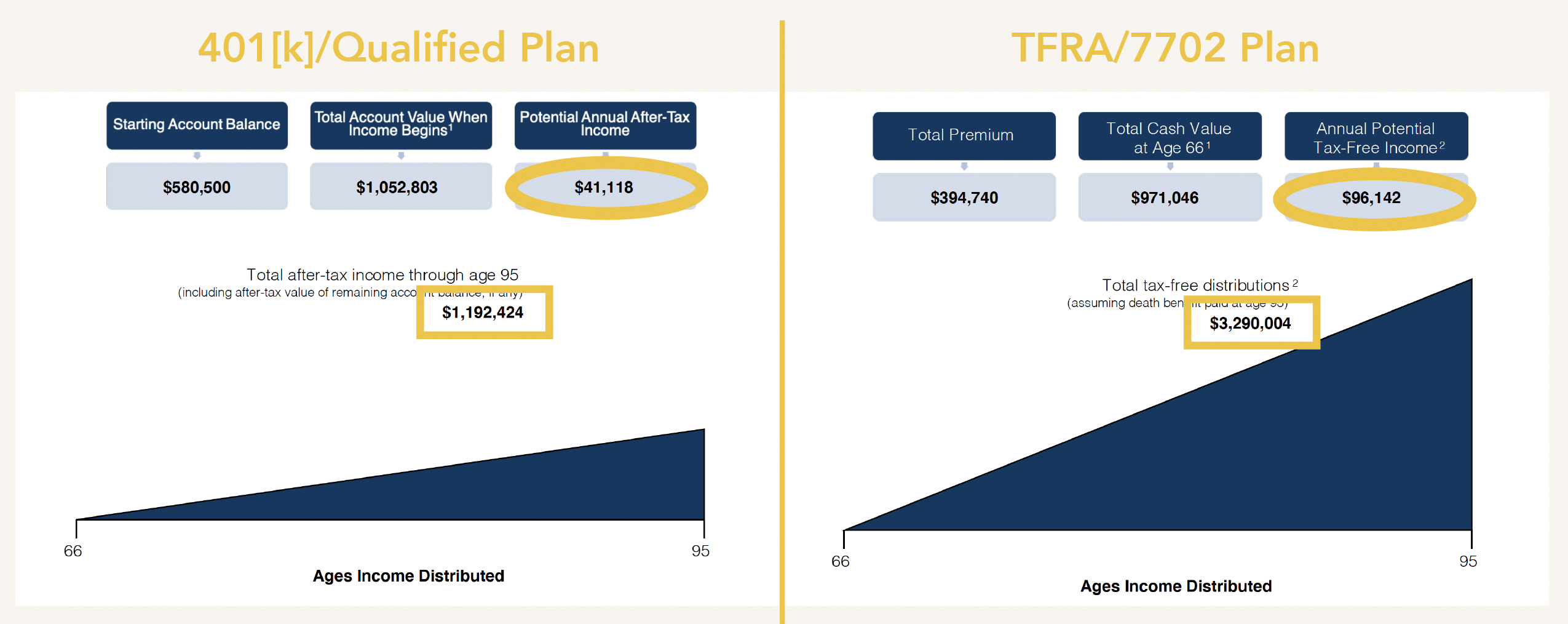

The custom reports we generate compare the options of using a Section 401(k) versus a Section 7702 plan.

The impact of tax-free is magnified in this report when you see how much more income 7702 plans can generate over qualified plans.

You can see what your money will do for you if you continue to save under the same tax code compared to using that money in a Section 7702 plan.

From these reports you can see the income from a Section 7702 plan is over 100% more than the Section 401(k) plan

Results will vary for each individual situation but you can expect between 40% and 60% more income from a TFFP plan.

In this situation this means over $2,000,000 more benefit over this person's life.

These are a sample of the report we generate for everyone to show you what your current situation is compared to what it could be with a TFFP plan.

To see if you qualify for a TFFP plan, contact the advisor who shared this with you.

Your custom reports will be generated to show you...

- What income your current retirement savings plan will generate.

- What your potential tax burden will be if you continue saving the same way.

- How much more income you can have from a TFFP plan.

- How much in taxes you will save by using a TFFP plan.